The Role of Robotic Process Automation in Financial Services - Exploring Key Capabilities and Benefits

Navigating the complexities of financial operations on a daily basis is quite challenging, particularly when dealing with large volumes of data, too many transactions, and highly sensitive information. This process in financial institutions cannot be overlooked or ignored, but it should be given double attention, which is time-consuming and laborious. The introduction of robotic process automation (RPA) can effortlessly transform financial services into a seamless operation with little to no manual intervention, allowing employees, consumers, and other stakeholders to spend less time on mundane tasks.

Designed to mimic human actions, the robotic process automation solution is a software technology that can be implemented for businesses handling financial services with extravaganza cost and time-consuming effort. While the role of robotic process automation solutions can be applied to a wide array of financial services, such as invoice processing, reconciliation, tax compliance, and budget forecasting, choosing the right RPA solution will help meet your business needs efficiently and effectively.

This blog explores the essential functionalities of robotic process automation (RPA) within the financial services sector, highlighting how selecting the right RPA consulting provider can maximise the effectiveness of these solutions.

Robotic Process Automation - An Overview

Let’s start with a brief overview of what an RPA is

Known for its automation capabilities, an RPA solution operates on rule-based scenarios and criteria, ensuring every human task is mimicked correctly to avoid errors and missing information. Implementing robotic process automation solutions helps enhance efficiency and increase the accuracy of financial results. The bot analyses every piece of data thoroughly, ensuring every financial operation, such as entering data, transaction processing, and consolidating information, is streamlined and digitised.

To learn more about RPA and its use cases in banking, read the blog where we explored an in-depth analysis.

Exploring the Impact of RPA on Financial Operations

Adopting RPA for financial services is an investment that organisations should consider if most of their business operations are repetitive and time-consuming. To prove the effectiveness of the RPA solution, let’s examine its key functionalities in financial services.

Automating Repetitive Tasks

Data entry and transaction processing are the two primary areas of financial services where the utilisation of robotic process automation solutions plays a major role.

- The RPA is programmed to extract information from various sources, such as PDFs, emails, or spreadsheets, and handle routine financial tasks such as payment processing, updating account information, and performing reconciliations. This helps organisations automatically populate the relevant fields across multiple systems, update account balances, and generate receipts simultaneously in real-time, eliminating the need for manual intervention

- As RPA bots operate on predefined rules and conditions, the precision and speed with which they handle large volumes of data entry and transaction processing are very accurate and reliable compared to manual involvement.

- Also, the ability to automate the reconciliation process by comparing records from different systems with internal ledgers helps flag errors or discrepancies, ensuring an error-free update.

- For example, when new customer information is received via email, the RPA bot reads the data and automatically populates it into the necessary systems all at once, easing employees from manual entry.

Enhance Compliance and Risk Management

As a highly regulated and sensitive sector, adhering to new regulations and compliance measures is an integral part of financial services’ effective functioning. The utilisation of RPA bots helps automate and standardise procedures, enhancing compliance and risk management.

- The implementation of robotic process automation in financial services helps organisations align with the latest regulatory requirements. Bots are trained to follow pre-defined rules and guidelines. This helps the bot apply the rules uniformly across all processes and operations performed by the organisation, eliminating non-compliance risks.

- The bot’s ability to automatically generate and record audit trails for every process helps organisations keep track of changes and edits, facilitating a transparent and traceable process if questioned about compliance adherence.

- Also, the RPA bot is capable of analysing, monitoring, and categorising transactions in real-time based on the level of risk involved. This helps the financial team be aware of fraudulent profiles in advance by flagging activities that the bot feels are unusual or suspicious.

- For instance, the bot can evaluate the risk level of a customer’s account or investment portfolio by cross-referencing it with risk models and regulatory requirements, ensuring that all risks are appropriately managed from the outset.

Streamlining Customer Communications

The significance of robotic process automation in financial services lies in automating customer interactions with faster responses and reliable solutions.

- The use of RPA bots in customer communication streamlines financial processes by automating the collection of mandatory details from documents, PDFs, and emails required for the customer onboarding process. The bot also handles customer queries with automated responses that are relevant and specific to the customer’s query, reducing the customer’s wait time.

- The bot also assists employees with the verification and validation of the submitted documents during the KYC process by automating the cross-referencing of customer data with external government portals. This increases the efficiency and accuracy of the validation, overlooking no details.

- Not just this, the RPA bot completely handles the entire onboarding process from start to finish, including setting up customer profiles, approving the account and meeting all compliance requirements without any errors or compliance issues.

- Consider this: If a customer wants to understand his or her account balance or update the account with new information, the bot instantly guides the user, ensuring the data is provided without much wait.

Supporting Decision-Making

Attending to financial reports in real-time is a necessity in today’s digital world. With robotic process automation services, businesses can confront irregularities in payables, fraudulent transactions, and incorrect entries as they happen, allowing employees and stakeholders to respond immediately.

- The RPA bot’s real-time capability is valued in financial services, where market conditions and trends constantly change, requiring swift responses to avoid a lag between analysis and decision-making.

- Automating the report collection process from various sources, such as transaction databases, customer account logs, and accounting software, enables the quick compilation of reports for decision-makers.

- The RPA bots are also programmed to present the data in a clear and actionable format that includes visual aids such as graphs and charts or highlights key metrics, facilitating easy comprehension of insights.

- For example, if stakeholders and decision-makers are too busy to glance at the report, an RPA-generated report helps them understand key areas of concern and trends and suggests potential solutions to navigate the challenges.

Thus, the key capabilities of the robotic process automation solution in financial services portray how every business operation and task can be enhanced, streamlined, and automated without errors, manual efforts, or inconsistencies.

Eliminate manual overreliance on repetitive and monotonous tasks. Explore our RPA solutions.

Implementation Challenges in Robotic Process Automation for Financial Services

Before we address the benefits of RPA bots for the financial sector, let’s discuss the challenges involved in implementing the robotic process automation solution.

- Legacy Systems: One of the most challenging concerns for RPA implementation is the existence of outdated and traditional systems in financial institutions. As legacy systems are incompatible in terms of software, hardware, and security, the integration of RPA solutions looks complex and concerning, disrupting the use of RPA bots to handle financial operations seamlessly and efficiently.

- Process Standardisation: With too many departments and branches, the way every financial task is carried out varies, and tasks and operations lack documentation. This makes it difficult for the organisation to get an account of the kinds of operations that need to be automated. Also, a one-size-fits-all RPA service will not work, as financial services differ from department to department.

Customising the robotic process automation solutions per department helps adhere to rules and conditions particular to that region. So, standardising the robotic process automation solution will help navigate this challenge. - Data Security and Compliance: As a highly sensitive sector, safeguarding data and documents from unauthorised access and data breaches is critical, especially during RPA implementation. Financial institutions must also adhere to compliance regulations such as GDPR, PCI DSS, and other data protection laws. It is highly doubtful that the RPA bots are programmed per these laws, specifically during cross-border data transmission.

- Scalability: Managing and maintaining multiple bots can be challenging for financial institutions, as each bot operates and responds in different ways, ensuring consistent performance. Also, as bot numbers increase, the need to update and maintain them periodically increases owing to changing regulations and system environments, which further adds to the operational burden.

- Cost Management: The upfront cost of investing in an RPA service is high due to front-end expenses such as software licenses, infrastructure updates and hardware. Evaluating the returns on investment, long-term benefits, and maintenance costs helps outweigh the pros and cons.

Overall, the challenges of integrating an RPA bot are crucial but manageable with careful planning, resource allocation, and the right kind of RPA solution provider. Addressing these challenges is essential for maximising the value of RPA and achieving long-term operational improvements.

Why Financial Institutions Can’t Afford to Miss RPA Benefits

As stated, robotic process automation integration is challenging yet significant if carried out with proper planning and careful evaluation. Maximising the potential of RPA bots enables the following key benefits for financial institutions, which are a never-miss opportunity

Increased Efficiency: RPA bots are known to mimic human actions swiftly and accurately compared to human intervention. Also, RPA bots are available 24/7, ensuring continuous financial operations for critical functions. This enhanced efficiency is not feasible with manual labour, as their availability is restricted to certain hours of work, posing a risk for necessary requirements.

Improved Productivity: One of the primary reasons for lower productivity among financial professionals is the need to focus on monotonous and mundane tasks. The integration of RPA bots frees up employees from performing data entry tasks or attending to customers on a daily basis. This assistance offered by robotic process automation solutions boosts the productivity and performance of employees.

Enhanced Accuracy: One of the highlights of robotic process automation solutions is the ability to automate repetitive and rule-based tasks. This allows the financial sector to minimise a large volume of errors and inconsistencies in transaction processing, account updates, and compliance adherence. The RPA bots ensure that every financial operation is performed and delivered with high levels of quality and reliability across all automated processes.

Better Customer Experience: RPA bots can simplify financial operations and consistently manage customer interactions, delivering an enhanced customer experience where customers are assured of fast and accurate responses.

Streamlined Data Management: Implementing robotic process automation solutions allows financial institutions to handle large volumes of data from multiple sources, facilitating accurate capture, organisation, and processing. This supports businesses with quality data that helps with precise and informed decision-making.

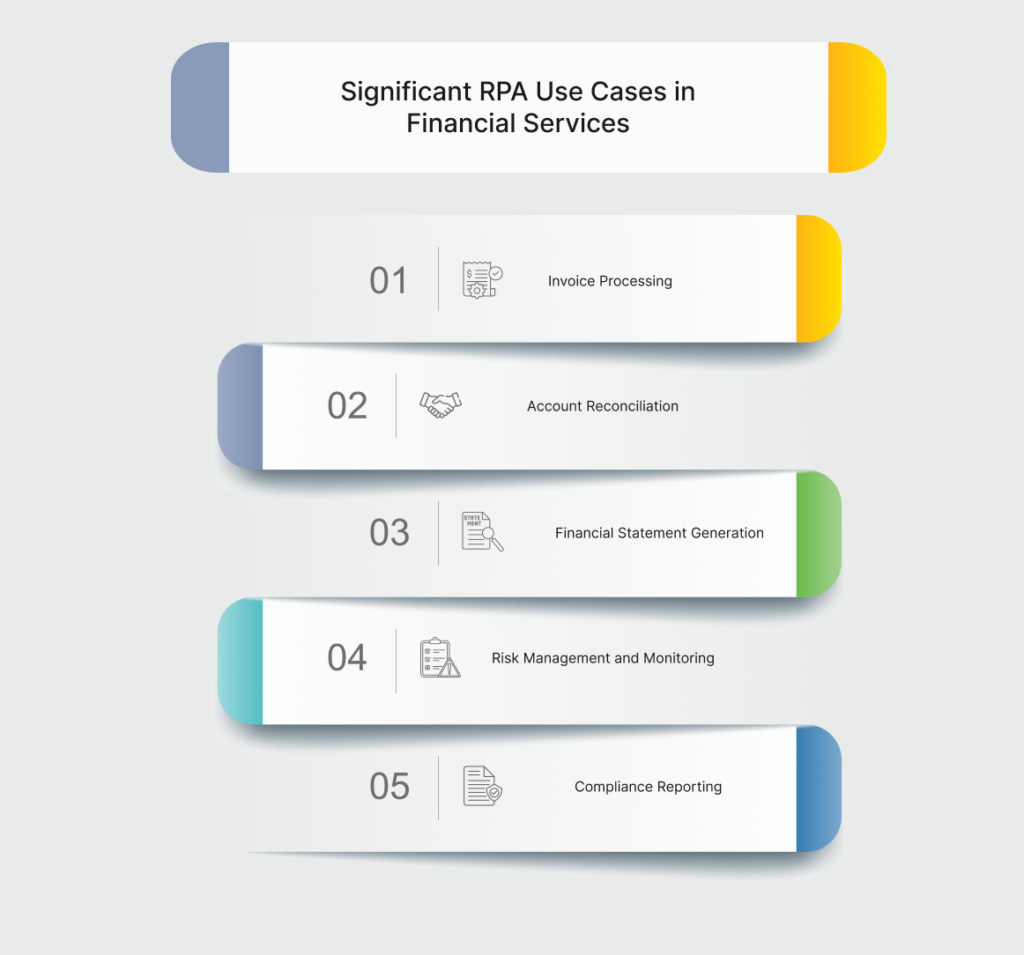

Significant RPA Use Cases in Financial Services

Before concluding, let’s examine some of the specific applications in which robotic process automation solutions significantly ease and enhance financial processes.

Invoice Processing: Helps automate the extraction, validation, and entry of invoice data across all financial systems, speeding up accounts payable processing and reducing errors.

Account Reconciliation: Facilitates the comparison of financial records across different financial accounts to identify errors, enabling accurate financial reporting.

Risk Management and Monitoring: Allows financial professionals to continuously monitor and track transactions and financial processes and automatically generate risk reports, helping institutions proactively manage and mitigate risks.

Compliance Reporting: Automates the generation of compliance reports by aggregating data from various sources, ensuring timely and accurate submissions to regulatory bodies.

Drive Financial Innovation with SquareOne's Tailored RPA Services

In the highly regulated and secure financial sector, the demand for automation solutions has surged, driving businesses to embrace robotic process automation (RPA). Selecting the right RPA service provider, such as SquareOne—a leading and experienced digital transformation partner—simplifies the implementation and integration of RPA bots. With SquareOne’s expertise, RPA solutions are customised to fit your business needs.

The team at SquareOne ensures that every aspect of your financial services is addressed, guiding you from the initial discussions through to post-implementation. Supporting employees and enhancing the customer experience are essential, not optional, and RPA makes this possible. With 15 years of industry experience, SquareOne excels at aligning innovation with customer needs. Transform your financial operations with the RPA consulting experts at SquareOne today.

Conclusion

In conclusion, the financial services sector faces increasing pressure to enhance efficiency, compliance, and customer satisfaction. A robotic process automation (RPA) solution has emerged as a vital tool to meet these demands, offering streamlined operations, improved accuracy, and reduced manual workloads. As a seasoned RPA solution provider, SquareOne ensures that your RPA implementation is seamless, effective, and tailored to your specific needs. With over 15 years of experience, SquareOne is well-equipped to guide your financial institution through every stage of the RPA journey, ensuring that you stay competitive in a rapidly evolving industry. Embrace the future of financial operations with SquareOne, where innovation meets expertise.