Strengthening Mobile Banking Experience with Enterprise Mobility Solutions

In a world where instant gratification is the norm, banking service is no exception. Customers today want more than just basic services—they demand seamless, secure, and fast mobile banking experiences. As mobile usage shifts from second nature to the primary mode of interaction, banks need to keep up with this shift or face the risk of falling behind. This is where Enterprise Mobility Solutions (EMS) come into play. By embracing EMS, banks can not only meet these rising demands but also offer the kind of personalised, anytime, anywhere service that today’s customers expect.

This blog presents the significance of EMS in strengthening today’s mobile banking experience. It highlights low-code platforms for developing enterprise mobility solutions and underlines their impact on efficiency, security, and scalability. The blog also explores the core components of EMS, its application in mobile banking, and its role in building a robust infrastructure for future-ready digital banking needs.

Transforming Banking with EMS - A Mobile-First Approach to Customer Experience

At a time where every swipe and tap matters, customer experience (CX) in banking has become the cornerstone of financial success. Today’s customers aren’t just looking for a bank; they’re seeking a partner that understands their needs, offers personalised solutions, and provides security at every turn.

But what do customers expect from banks? Let’s dig into the data:

- Expedited Service – 72% of customers demand swifter and more efficient banking services, pushing the limits of traditional banking infrastructure.

- Personalisation at Scale – 77% of banking leaders believe deep and data-driven personalisation can improve customer retention.

- Multi-channel Consistency – 70% of customers prefer a consistent banking experience across channels, underscoring the need for robust and interconnected systems.

- Mobile-first interactions – 81% of customers interact with banks via their mobile channels, highlighting the shift towards mobile-centric strategies.

As the digital era reshapes the financial landscape, the role of mobile banking has evolved from a convenient feature to a fundamental pillar of customer engagement. With 90% of banks worldwide expected to integrate mobile banking fully, this rapid adoption is a direct response to shifting customer behaviours and the escalating demand for digital transformation.

This is where EMS becomes indispensable. EMS is not merely an add-on; it’s the technological framework that enables banks to deliver a secure, responsive, and scalable mobile experience. By leveraging EMS, financial institutions can ensure that their mobile platforms are not only user-friendly but also fortified against emerging security threats, all while optimising operational efficiency.

Investing in EMS is a strategic move that goes beyond customer satisfaction—it’s about future-proofing the banking experience. By integrating EMS, banks can create a dynamic, mobile-first environment that drives both customer loyalty and business growth. In a world where technology and finance are inextricably linked, EMS provides the tools needed to stay ahead of the curve, ensuring that banks can effortlessly meet the expectations of their customers.

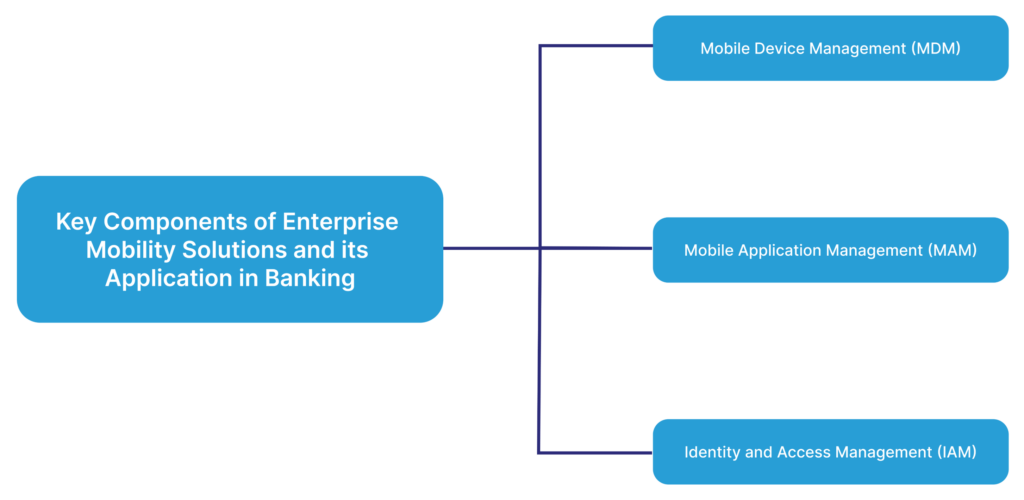

Key Components of Enterprise Mobility Solutions and its Application in Banking

The EMS architecture helps organisations manage their wide-scale mobility applications. As mobile applications become ubiquitous and remote accessibility becomes paramount, managing mobile-centric applications, devices, and networks is essential for operation-friendly processes.

To truly understand EMS’s enduring impact on strengthening the mobile banking experience, let’s quickly explore its key components and discern its application:

- Mobile Device Management (MDM): This is a core component that actively monitors and manages the mobile devices used across the banking ecosystem. With centralised control over all user and device data, MDM ensures secure and compliant use of mobile devices in banking operations.

- MDM enables financial institutions to implement security protocols such as device encryption, password protection, etc.

- Since the finance sector is highly regulated, adherence to regulations such as GDPR and others is imperative. MDM supports banks in enforcing strict compliance by managing data access and storage.

- Real-time monitoring of connected devices is significant in preventing potential security threats. Thus, MDM assists in proactively monitoring devices, which minimises security risks and ensures robust oversight.

- Mobile Application Management (MAM): The other pivotal aspect of managing mobile banking is its application management. From usability to security, mobile banking completely relies on its applications. Hence, MAM is essential in maintaining the security aspects as well as the user-friendliness of applications.

- In the realm of security, MAM plays a crucial role. From enforcing granular policies to protecting applications and administering deployment and updates, it ensures that only authorised apps have access to banking data.

- While security is significant in mobile banking applications, customer experience and interaction with the application remain equally important. MAM enables financial institutions to evaluate the state and health of application performance and assists in enhancing user satisfaction.

- Identity and Access Management (IAM): IAM is an extension of security that predominantly focuses on customer authentication. Financial institutions should be wary of the fact that customers who use the applications are diverse, and some can be potential risks. Therefore, mobile banking needs to have security measures in place that safeguard operations from potential risks. IAM aids in customer authentication and fraud prevention in mobile banking.

- With robust authentication mechanisms like multi-factor authentication, IAM reduces authorisation risks and protects operations.

- IAM implements role-based access control to restrict certain functionality access to minimise the risk of frauds and data breaches.

- Integrating advanced analytics and detection tools, IAM aids in identifying anomalous behaviours that prevent frauds from escalating.

Leveraging Low-code Platforms for Enterprise Mobility Solutions

Development, deployment and support of Enterprise Mobility Solutions are extremely complex and challenging. With long development life cycles, cross-platform compatibility, scaling and monitoring issues, the traditional approach to enterprise mobility solutions is inefficient.

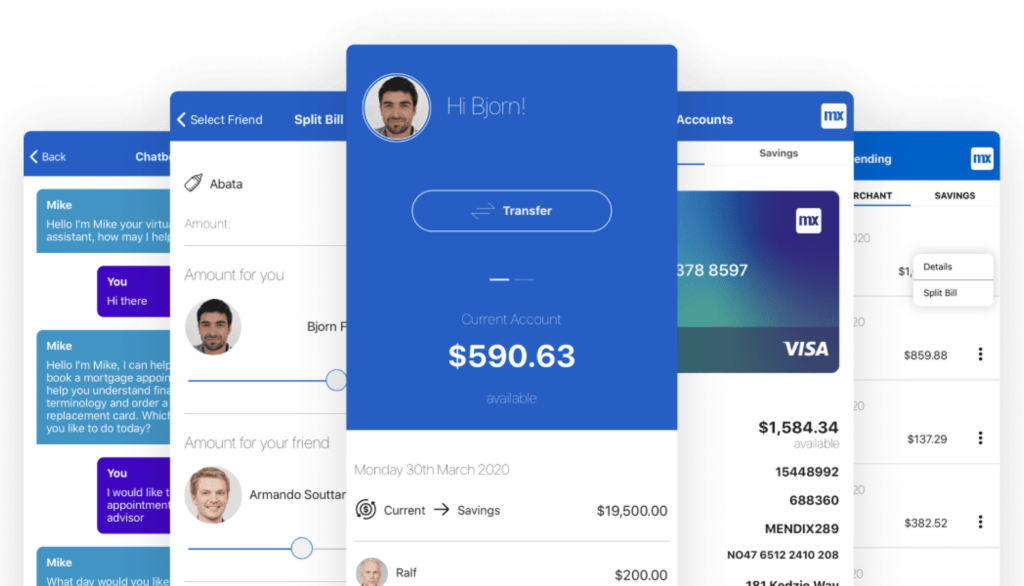

Low-code presents an innovative approach to this. With a more accessible and agile way to develop enterprise-grade solutions, low-code solutions have visual interfaces and pre-built templates that simplify the application development cycle. By accelerating development, deployment and testing of mobility solutions, low code assists in significantly expediting time-to-market.

Mobility solutions for banking needs demand an integrated infrastructure that supports scalability, security, and seamless integration with core banking systems. To achieve this, low code solutions facilitate rapid development, deployment, and customisation, which supports enhanced user experience, security and integration. Here’s a quick rundown on how low-code platforms make this possible:

- Faster Development Cycles: Low-code platforms save hours on extensive manual coding and support development initiatives with easy visual interfaces and pre-built components. This allows financial institutions to develop and deploy mobility applications that can fulfil user demands, secure mobile banking experiences, and test new features.

- Compatibility with the core banking system: Unlike traditional development platforms, which require manual integration with core systems, low-code solutions effortlessly ensure smooth integration, enabling real-time data access and synchronisation. This allows the mobility solution to provide seamless and comprehensive banking services to customers.

- Personalised User Experience: Banking customers crave a personalised experience that aligns with their unique preferences. They anticipate service that anticipates their needs and provide tailored solutions. Low-code solutions can be instrumental in addressing this. With the flexibility to design user interfaces and create personalised banking experiences, low-code solutions enable banks to roll out specific and engaging mobility applications.

- Augmented security and compliance: Built-in security features in low code solutions provide a robust framework to maintain high security standards that are required for banking mobile applications. With seamless support for authentication, encryption, and other security measures, low code solutions are ideal for secure mobile experiences and will also adhere to industry regulations and compliance standards.

- Rapid iterations and updates: In banking environments, the introduction of new features, updates, and enhancements is normal. But without supporting infrastructure, banks struggle to implement these changes and reflect them on their mobile applications. Low-code solutions are transformative in this regard. By allowing rapid testing and iterations, banks can respond to customer feedback swiftly, making the approach customer-centric and effective.

Business Impact of using Enterprise Mobility Solutions in mobile banking service

Integrating EMS into banking services can transform your banking operations. Let’s explore how key components of EMS drive business growth and operational excellence:

Business Area | Impact | Result |

|---|---|---|

Data-driven decision making | Leverages real-time data to refine financial services that enhance the mobile banking experience. | Improves ROI through data-backed, customer-centric strategies minimises risk exposure, and optimises product-market alignment. |

Customer Retention & Acquisition | With faster, frictionless mobile experiences, EMS elevates the user experience, provides personalised services and drives long-term customer loyalty. | Increases retention rates, lowers churn, and drives new customer acquisition through improved banking experiences. |

Cost efficiency | By automating workflows, simplifying banking operations and increasing accessibility, EMS can significantly reduce operational costs and expedite service delivery. | Minimises operational expenses and increases profitability. |

Augmented Banking | EMS enables the integration of AI and data analytics into mobile banking services, allowing for features such as personalised financial advice and other improved services. This enhances the overall banking experience and opens new revenue streams. | With advanced banking features, banks can expand their reach and drive business growth through innovative means. |

Operational optimization | Streamlines operations like loan approvals and compliance checks, which frees up time for other strategic initiatives. | It cuts processing times, reduces error rates, and enables the reallocation of resources toward higher-value tasks. |

SquareOne’s expertise in EMS and low-code

Conclusion

Enterprise Mobility Solutions is a transformative approach towards modernising banking services. It is specifically geared towards agile access, enhanced security and scalability. Financial institutions seeking to provide enhanced customer experience, secure digital banking service, and optimise operations can greatly benefit from integrating low code platforms. By leveraging low code platforms such as Mendix and Microsoft Power Apps to develop, deploy and test EMS for banking, financial institutions can accelerate innovation, streamline complex workflows, and deliver personalised, real-time financial services that meet evolving customer demands.

Connect with the experts at SquareOne to harness the power of EMS today!