Enhancing Customer Due Diligence in Regulated Sector via Identity Verification Solution

Introduction

As technologies are advancing every day, companies in regulated industries are transitioning to more secure environments and evaluating success based on more than just profit. This includes prioritising security and regulatory compliance to assess their customer’s information based on a risk-based approach. Every year, a huge sum of cash in millions and billions flows illegitimately, such as money laundering, corruption, tax evasion, identity theft, and more through the financial system, go unnoticed.

Regardless of the various laws that are implemented to avoid such unlawful acts, organisations must go the extra mile to understand the customers they engage with. That’s when the identity and verification solutions come into play, strengthening customer due diligence by assuring accurate user authentication, mitigating the risk of fraudulence, adhering to KYC (Know Your Customer) and AML (Anti-money Laundering) guidelines. Additionally, it prevents cyber threats, financial terrorism, and other risks by verifying identities, detecting suspicious activities, and protecting financial systems against unauthorised access.

This comprehensive blog explains the vital role of identity verification solutions in enhancing customer due diligence in regulated industries. It emphasises how customer due diligence helps entities in these industries by assessing the customer’s profile using a risk-based approach.

How Does Customer Due Diligence Work in Regulated Industries?

Customer due diligence (CDD) is a cornerstone compliance measure designed to assess and monitor customer risks in regulated industries. It involves verifying a customer’s identity, evaluating their risk profile, and maintaining accurate records to ensure adherence to Know Your Customer (KYC) and Anti-Money Laundering (AML) guidelines.

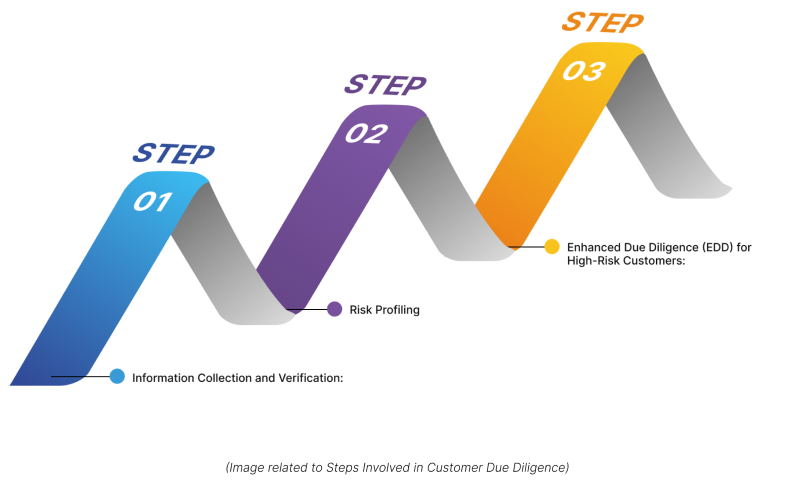

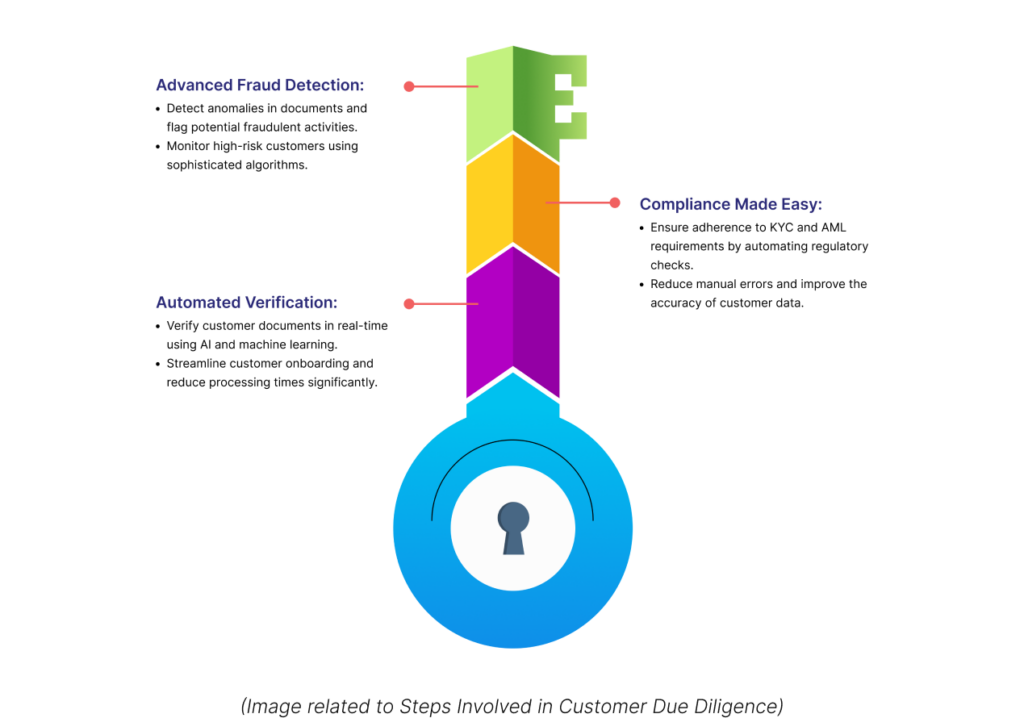

Steps Involved in Customer Due Diligence

Here are the several steps involved in customer due diligence (CDD):

1. Information Collection and Verification:

- Obtain key documents like identification proof, address proof, and other necessary details.

- Verify the authenticity of these documents through manual or automated processes.

2. Risk Profiling:

- Classify customers into low, medium, or high-risk categories.

- Risk factors include geographic location, transaction behaviour, and exposure to financial crime.

3. Enhanced Due Diligence (EDD) for High-Risk Customers:

- For customers flagged as high risk, apply stricter scrutiny, continuous monitoring, and advanced verification checks.

The foundation of CDD lies in KYC and AML frameworks. KYC ensures businesses accurately identify their customers, while AML prevents financial systems from being exploited for illegal purposes. Together, they strengthen regulatory compliance, enhance trust, and reduce financial crime.

When is CDD Necessary?

Here are the situations where CDD (customer due diligence) is required:

- During customer onboarding, validate identities and assess risk levels to make sure the customers are genuine and meet regulatory standards. Customer due diligence avoids unauthorised access to the financial system, building a foundation of trust for future transactions.

- For large or unusual transactions that deviate from regular activity, CDD ensures that these transactions are genuine, prevents fraudulent activity, and flags suspicious activities, securing companies from financial and reputational risks.

- When dealing with customers or regions considered high-risk. CDD applies strict regulations to such customers and locations, mitigating significant threats by imposing enhanced monitoring and compliance measures.

- If suspicious activity arises, indicating potential involvement in illegal practices. CDD helps to identify and report such activities, bypassing the risk of financial crimes and securing compliance with regulatory obligations.

Industries such as banking, insurance, real estate, gaming, and cryptocurrency exchanges are legally bound to implement CDD processes. Financial institutions across countries like the US, UK, EU nations, Canada, Australia, and UAE, among others, are heavily regulated to enforce CDD, reflecting its global importance in mitigating risks and ensuring transparency.

The Role of Identity Verification Solutions in Enhancing CDD for Regulated Industries

Identity verification solutions are indispensable for robust customer due diligence(CDD) in the financial sector. These solutions streamline the verification process, reduce manual errors, and ensure compliance with stringent regulations. Financial institutions face growing regulatory pressure to prevent fraud, money laundering, and identity theft, making these solutions vital.

Key Roles of Identity Verification Solutions:

1. Automated Verification:

- Verify customer documents in real-time using AI and machine learning.

- Streamline customer onboarding and reduce processing times significantly.

2. Advanced Fraud Detection:

- Detect anomalies in documents and flag potential fraudulent activities.

- Monitor high-risk customers using sophisticated algorithms.

3. Compliance Made Easy:

- Ensure adherence to KYC and AML requirements by automating regulatory checks.

- Reduce manual errors and improve the accuracy of customer data.

Identity verification solutions enhance CDD by automating the process of verifying documents and cross-referencing them against trusted databases. They validate identities in real-time, reducing onboarding times and improving the customer experience. By leveraging AI and machine learning, they detect anomalies, flag fraudulent documents, and monitor suspicious activities efficiently.

For instance, Regula’s identity verification tools, offered by SquareOne, enable businesses to analyse customer identity documents. This ensures accuracy and consistency, even for remote onboarding scenarios.

A real-world example includes banks using identity verification solutions to verify documents in less time, ensuring compliance and reducing operational burdens. These tools also help mitigate risks for high-risk customers through advanced checks, contributing to the overall integrity of financial systems.

SquareOne Technologies – Enhancing Customer Due Diligence in Regulated Sectors With Regula’s Identity Verification Solutions

SquareOne is a leading provider of identity verification solutions committed to empowering businesses across industries. Through its strategic partnership with Regula, SquareOne offers innovative identity verification solutions, such as KYC automation, that simplify customer onboarding while ensuring compliance with regulatory requirements.

Regula’s technology brings unmatched expertise in document verification, supporting businesses with a vast database of global ID templates and advanced AI tools. Whether for banking, healthcare, or e-commerce, SquareOne ensures seamless integration, empowering enterprises to enhance customer trust and safeguard sensitive data.

SquareOne’s dedication to innovation and compliance makes it the ultimate choice for businesses seeking to enhance CDD and meet global regulatory standards.

Conclusion

In regulated industries, customer due diligence (CDD) is no longer optional; it is an essential component of maintaining financial integrity and ensuring compliance. The growing sophistication of financial crimes necessitates advanced identity verification solutions to meet today’s challenges. Partnering with Regula, SquareOne offers a seamless approach to verifying identities, automating compliance checks, and mitigating risks.

By investing in these identity verification solutions, businesses can streamline their operations, enhance customer trust, and comply with global regulations without compromising efficiency. From reducing onboarding time to preventing financial crimes, the value of these technologies is unparalleled. Organisations that prioritise CDD not only safeguard their interests but also contribute to a more secure and transparent financial ecosystem. SquareOne, with its state-of-the-art solutions, stands out as a reliable partner in this journey, helping businesses thrive in an increasingly regulated world.

Are you looking for an effective identity verification solution to enhance customer due diligence for businesses in regulated industries? Contact experts at SquareOne today!