A Guide for Smart Financing - How to Leverage AI and Machine Learning in Financial Services

In today’s digital-driven world, artificial intelligence (AI) and machine learning (ML) are not buzzwords; they are not just trends but game changers for industries. Specifically, in financial services, they enhance efficiency, accuracy, and decision-making capabilities.

Struggling with outdated financial strategies and slow decision-making?

Without AI and machine learning in financial services, you’re missing out on advanced insights, faster processing, and smarter investment decisions.

Let’s delve into the blog to understand AI and machine learning solutions, their importance, benefits, key factors, and challenges to effectively leverage these technologies in financial services.

Understanding AI and Machine Learning Services in Finance Services

Artificial intelligence (AI) and machine learning (ML) have been cornerstones of the financial services industry. They automate various human-centric and technical tasks. ML makes it possible to achieve qualified insights from raw data, both structured and unstructured.

Likewise, AI helps financial institutions, businesses, and decision-makers create financial plans based on their goals and circumstances

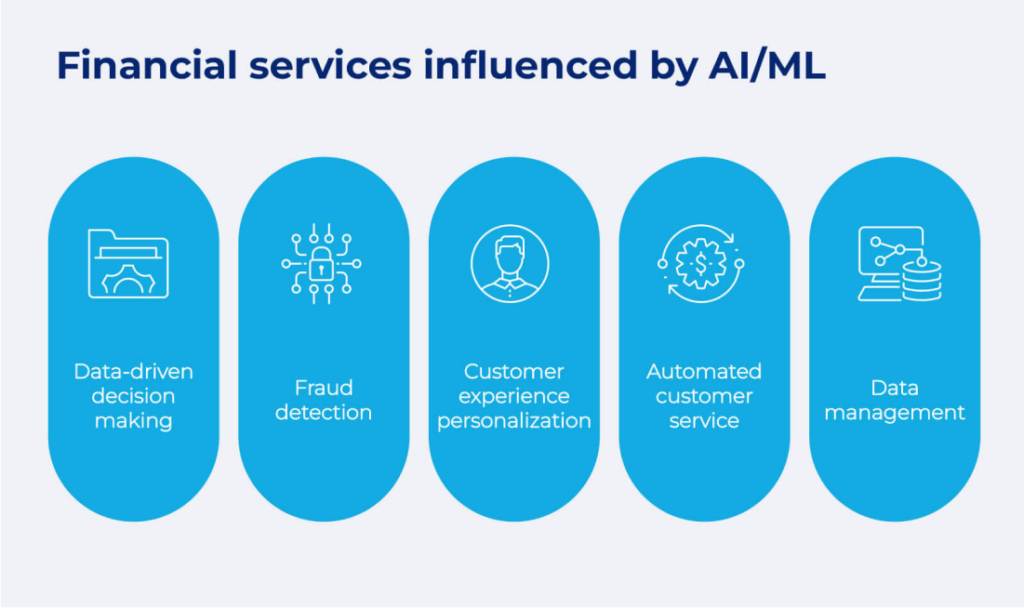

Important transformations in financial services caused by AI and ML are :

1. Enhanced System Effectiveness

AI and ML can optimise better decisions, financial markets, insurance contracts, and customer interactions, leading to a streamlined and effective financial system. These technological advancements help businesses enhance regulatory compliance and ensure financial services adhere to the regulatory guidelines.

2. Maximises Data Value

AI has completely transformed the ability to analyse, discover, and process data, particularly for intricate tasks like Know Your Customer (KYC). It has developed smarter, more proactive search systems that are aware of specific tasks. ML learns from data trends and delivers more accurate and useful results over time.

3. Improved Customer Experience

AI-enabled algorithms understand and analyse large volumes of customer data and offer tailored solutions and recommendations. It is available with 24/7 support and adapts to customer needs in real-time.

4. Enhances Risk Management

AI and machine learning solutions can analyse market trends, historical data, and customer purchase patterns, allowing for more accurate credit scoring, fraud detection, and risk mitigation. These technologies facilitate personalised financial services, enhance the customer experience by predicting needs, and reduce operational costs.

Use Case:

A prominent nationalised bank in Canada leveraged multiple AI-embedded products for its financial services to simplify financial management by tracking spending, automating budgets, and forecasting cash flow. Their AI trading platform also adapts to real-time market conditions, leading to improved trading outcomes and insights.

Moreover, the bank’s advancements have significantly enhanced client interactions and business decisions. A strong commitment to addressing issues of fairness, bias, transparency, and privacy complements these efforts, ensuring the safe and ethical development of AI technologies.

Influencing AI and Machine Learning in Financial Services: Key Factors

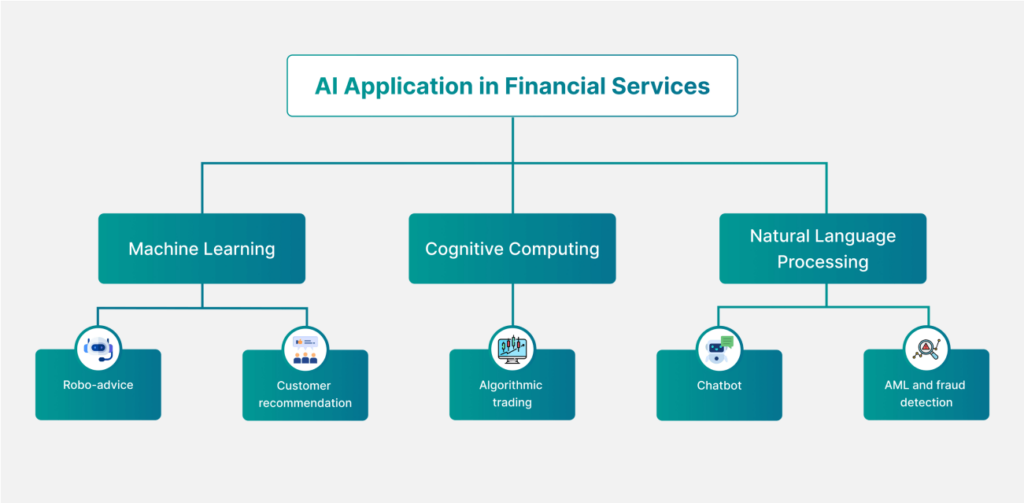

Machine learning comprehends a large volume of data and predicts future trends. Artificial intelligence (AI) has significantly impacted financial services in numerous ways, including

- Forecasting scenarios

- Regulatory compliance

- Product development

This will lead to greater advancements in operational efficiency and innovative financial solutions.

Let’s break down the factors that influence AI and machine learning in financial services:

1. Technology Advancement

Integrating AI and ML in financial services helps to build new products and services that optimise financial performance. Specifically, fintech companies are leveraging these technologies to create innovative solutions.

These technologies embrace predictive analysis to improve credit scoring and enable better risk assessment. AI and ML streamline financial services to the next level, such as repetitive business tasks and tedious activities.

Many financial management firms leverage and build chatbots to offer investment advice and real-time market updates. With a systematic approach, they analyse financial reports to make updated decisions.

Emerging advancements, such as blockchain and cryptocurrency, have taken an important place in financial management. The purpose of blockchains is to improve transparency and traceability, allowing them to monitor and analyse financial transactions.

2. Market Demands

Previously, there were fewer requirements and less competition in financial management, resulting in lower market demand. As a result, economic strategies and services were minimal and less tailored to individual needs. Now, the financial market has transformed into a highly competitive one and strives for AI and ML mechanisms.

Since consumers expect more tailored and secure services, financial solutions must be data-driven and capable of adapting to evolving customer needs. AI and machine learning solutions effectively meet these market demands by offering enhanced security and personalised customer service, which fosters today’s and future consumers’ demands.

3. Increased Data Availability

In financial services, as the number of transactions, customer interactions, and regulatory needs increases, the data volume grows, extracted from various sources, including social media transactions. This means that the complexity of managing and analysing large amounts of data also grows.

AI and machine learning in financial services are based on data designed to perform business operations without delays. This means that these solutions can handle large volumes of data and continue to operate by offering cloud storage options.

In addition, AI and ML automate data analysis, recognising patterns, enabling real-time insights, and improving predictive accuracy for better decision-making.

Benefits of AI and ML in Finance Services

- Accuracy of Prediction: AI and ML have the potential to analyse large amounts of data and improve the accuracy of financial predictions, which enables financial institutions to make data-driven decisions. By leveraging vast datasets and advanced algorithms, these tools deliver precise forecasts, helping financial services in strategic planning.

- Cost Savings: Financial services are constantly evolving with innovations, but they still struggle to balance cost reduction and technology striving to reduce expenses. AI and machine learning solutions open new opportunities in financial services by accelerating business processes, automating workflows, improving productivity and reducing manual intervention.Choosing a reputable digital transformation company that provides prominent artificial intelligence and machine learning services that assist you in implementing cost reduction strategies and solutions yields tangible results.

- Optimises Business Operations: Financial institutions leverage AI and ML to improve services and create comprehensive predictive models. This approach not only helps save costs but also enhances the customer experience by reducing service interruptions. AI in financial services optimises workforce management, allocating resources based on real-time demand, leading to better service delivery and increased profitability.

- Better Decisions: Decisions in financial services are the most crucial tasks, directly impacting risk management and customer satisfaction. They require a blend of data analysis and market insights to ensure successful outcomes. AI and ML solutions highlight financial services with data-driven insights for better decision-making. By using AI to evaluate potential borrowers’ credibility, banks can improve the quality of their loan portfolios, decrease the probability of defaults, and make better lending decisions.

- Identify Patterns and Predict Outcomes: By extracting key insights and analysing large data volumes, ML can predict the outcomes accurately. AI and ML in financial services analyse historical data to identify risks, enabling the development of efficient risk management approaches and achieving possible outcomes. These technologies not only predict potential challenges but also guide informed decision-making for better financial stability.

- Reduce Risks: AI and ML help reduce financial risks by improving fraud detection, credit scoring, and market analysis. AI-driven predictive analytics provide financial institutions with powerful tools to forecast market trends, credit risk, and customer behaviour. With the help of ML, financial services can detect and mitigate risks more accurately, improving overall operational resilience.

AI and Ml-Driven Innovations in Financial Services

1. AI and ML for Enhanced AML Compliance

An increasing transaction volume presents a challenge for financial institutions in maintaining reliable anti-money laundering (AML) software. AI and Ml-enabled AML solutions can efficiently process and analyse large datasets, as well as detect suspicious patterns and potential money laundering activities. This enhances compliance, reduces manual effort and mitigates risks, ensuring regulatory adherence and protecting the bank.

2. AI Chatbots Improve Customer Service in Banking

Customers often face a long wait time when trying to resolve simple banking inquiries. AI and ML-enabled chatbots address these issues by offering instant responses to common queries, processing transactions, and guiding users through online services.

These advanced solutions learn from customer details and past interaction patterns, reducing response times and ultimately boosting customer satisfaction.

3. Simplifying Complex Financial Data with AI and ML

Financial institutions can find it challenging to process complex rules and unstructured data. ML and artificial intelligence solutions simplify this by instantly summarising regulations and contracts, easing compliance, and efficiently managing large datasets and financial documents through smart, data-driven insights.

Challenges of AI and ML in Finance Services

Artificial intelligence and machine learning services have the potential to bring unparalleled efficiency to the financial services industry. However, the financial sector, characterised by its complexity and stringent regulations, faces significant hurdles in adopting these advanced technologies.

Let’s examine the challenges of ML and artificial intelligence in financial services:

Security Concerns

Whether a financial institution is small or large, security has been a major concern, even while integrating AI and ML in financial services. Using these technologies means dealing with a lot of sensitive data, which can attract cyber offenders.

Strong security measures are crucial to protect against potential threats and data breaches. Addressing these security challenges is essential to maintaining trust and integrity in AI and ML applications within the financial sector.

Integration with Business Processes

Financial institutions often have legacy systems that are not built to accommodate advanced AI technologies. Integrating these systems smoothly requires extensive IT work, which can be tedious and expensive.

Besides, consider choosing advanced financial AI and ML solutions that align with your financial service objectives and operational workflows. This choice requires a thorough understanding of both the technology and how your business operates.

Poor Data Quality

Producing accurate results requires extensive qualitative datasets when it comes to AI and ML solutions in financial services or any other business. Inconsistent and incomplete data can lead to unreliable outputs and flawed decision-making. Investing in powerful AI-based data management practices, including data cleansing, validation, and integration, ensures the accuracy of the information.

Lagging in Deployment

The complexity of deploying AI and ML models with existing systems in financial services contributes to the slow pace. It faces various challenges, including training data bias, ethical variability, complex transparency, and governance needs.

To overcome AI deployment challenges in finance services, implement robust data validation and fairness techniques to reduce bias in training data. Additionally, establish and adhere to clear ethical standards to ensure high-quality data for AI model development.

High Development Costs

There is no standardised cost for implementing AI and machine learning in financial services. Costs fluctuate based on the specific business model, objectives, and operational requirements, as AI and ML solutions vary accordingly.

To manage this, you should utilise cloud-based artificial intelligence and machine learning services and pre-made models, collaborate with relevant AI and ML service providers, train your team, effectively manage resources, and adopt flexible development methodologies.

Transform financial operations with SquareOne’s AI and machine learning solutions. Streamline processes, enhance customer experiences, and gain predictive insights with our tailored strategies. Boost efficiency, reduce risks, and drive success in financial services by leveraging advanced data analysis, NLP, and automation.

Steps to Leverage AI and Machine Learning in Finance Services

Financial artificial intelligence and machine learning transformed and kept improving, optimising operations and actionable insights, driving efficiency and innovation. To harness these advancements effectively, financial institutions must adopt a strategic approach that integrates AI and ML solutions into their core operations.

Let’s explore the steps to leverage AI and ML solutions in financial services.

1. Define your Business Goals

Before implementing AI and machine learning solutions in financial services, clearly define your goal. This goal should include enhancing operational efficiency, improving customer satisfaction, and reducing operational costs.

Ensure that AI and ML solutions effectively meet these objectives. Set measurable targets and key performance indicators (KPIs) to help track progress and success. Evaluate various platforms for their capabilities, scalability, and compatibility with your existing infrastructure. Make sure the platform supports the specific AI and ML tools and libraries you need.

2. Collect and Prepare Data

Collect and prepare data from diverse sources, ensuring it undergoes qualification, cleansing, and validation for AI and ML models. Use data from transactions, customer interactions, and market trends.

Organise the data into structured formats, such as databases or data warehouses, to facilitate simple access and analysis. Quality data is important for building reliable AI and ML models; ensure that you implement data governance practices to manage and protect data assets.

3. Pilot Testing

Before fully deploying AI and ML solutions, begin with a small project that saves your resources. Conducting pilot projects ensures that potential issues are identified, feedback is collected, and necessary adjustments are made. Assessing pilot outcomes against predefined KPIs from the pilot implementation will help you to make decisions on broader deployment in financial services.

4. Integrate with Existing Systems

Collaborate with professional teams to ensure compatibility and minimise disruptions throughout the integration process. Ensure that the integrated systems facilitate a smooth workflow and boost the overall efficiency of operations. Effective integration allows AI and ML to complement and improve current operations, driving better outcomes in financial services.

5.Deploy and Monitor

Implement AI and ML solutions in financial services into existing financial systems and continuously oversee their performance. After the deployment of these technology solutions, ensure stakeholders receive comprehensive training.

This ensures they fully understand AI and machine learning solutions and can effectively use them in their roles. Implement continuous monitoring to track performance, detect anomalies, and ensure the solutions meet business goals.

6. Ensure Security Capabilities

Validating security is the top priority for financial services, where safeguarding sensitive data and maintaining trust is essential to their operations and customer relationships. Implement robust security measures to protect AI and ML systems from cyber threats and data breaches. Conduct regular security audits and vulnerability assessments to identify and address potential risks.

7. Scale and Optimise

Scale AI and ML solutions in financial operations step by step once they achieve success in each area, such as customer engagement, fraud detection and compliance reporting.

In financial services, use cloud AI and machine learning for resources to manage scalability and ensure cost-effective expansion. Monitor the impact of scaling on overall business performance and make adjustments as needed.

8. Continuous Improvement

Update AI and ML models regularly with fresh data to keep them accurate and relevant. Stay informed about the latest AI and ML advancements to ensure your solutions are up-to-date. Continuous improvement helps these technologies stay effective and adapt to changing business needs.

Transform Financial Services with SquareOne’s AI and Machine Learning Solutions

SquareOne provides coherent artificial intelligence and machine learning consulting services in the UAE to streamline financial services. As financial institutions face the challenge of harnessing vast amounts of data and adapting to new technologies, SquareOne offers prominent AI and ML solutions tailored to their needs.

Are you struggling to integrate AI and ML into your financial services? Connect with SquareOne’s expert team to streamline your financial operations, ensuring alignment with your goals through end-to-end digital transformation and a customer-focused, transparent approach.

Final Note

As you seek smarter financing solutions, it is evident that AI and machine learning are pivotal in transforming financial services. They enhance customer experiences, drive better outcomes, and maintain a competitive edge. Investing in advanced AI and ML solutions optimises financial operations, leading to greater efficiency and improved decision-making.

Connect with SquareOne to elevate your financing complexities with prominent AI and machine learning development services. Utilise data analysis, natural language processing (NLP), predictive modelling, adaptive algorithms, and automation to reduce fraud and achieve sustained growth and success.

FAQs

The role of AI and machine learning in financial services is to automate processes, enhance data analysis, and deliver tailored customer experiences by assisting customers in meeting their goals.

AI in financial services makes operations easier by automating routine tasks, detecting fraud, managing risks, and optimising investment strategies. Chatbots, machine learning algorithms, and predictive analytics are ways that financial institutions can leverage AI.

Machine learning is a subset of artificial intelligence that helps financial services by analysing large datasets to understand and predict risks for customers as well as businesses.

AI and machine learning in financial risk management are important because they significantly improve the ability to predict and mitigate risks. By recognising patterns in financial data, AI in financial services can identify anomalies and deviations that signal potential risks.

AI and machine learning solutions in fintech can automate manual, routine operations, freeing up time and resources for more strategic initiatives. These solutions help fintech provide customer-centric services that align with evolving market trends while also improving credit scoring, fraud detection, and risk management.

AI and machine learning detect suspicious trends and anomalies in massive transaction data to prevent money laundering. They help detect odd actions in real-time, indicating money laundering schemes for further investigation and improving compliance.

Artificial intelligence solutions in banking to boost efficiency, strengthen security, and enhance customer experiences through advanced cybersecurity, fraud detection, chatbots, improved loan and credit decisions, personalised interactions, and predictive analytics, ultimately leading to faster services, reduced risks, and higher customer satisfaction.

Machine learning helps banks by automating tasks like loan approvals, fraud detection, and customer service. It also improves credit scoring, risk management, and customer targeting and enables personalised marketing and financial products.

AI can predict financial trends by analysing historical data, identifying patterns, and forecasting changes like inflation, interest rates, and stock prices. It also provides customised financial advice, detects fraud, improves credit scoring, and automates tasks for better decision-making.

Yes, AI will be a boon for Banking, Financial Services, and Insurance (BFSI) companies.

AI in financial services, specifically in the banking sector, can be achieved by analysing large datasets to uncover valuable insights that human analysts might miss, reducing costs, improving efficiency, and enabling faster decision-making. AI’s ability to automate tasks, analyse data and predict outcomes will help BFSI companies stay competitive and innovative.