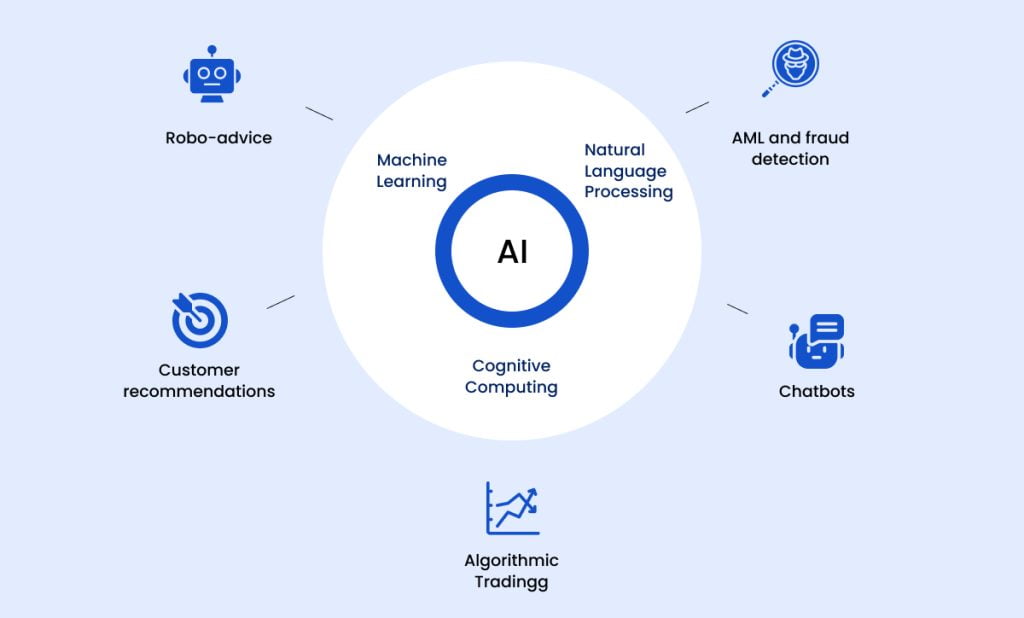

The advent of automation and AI in financial services has brought about a technological revolution. As we sit at the intersection of the financial services industry and cutting-edge technology, it is essential to recognize the transformative power of artificial intelligence (AI) and automation. In this blog post, we embark on a journey into the heart of the financial sector, exploring how these innovative technologies are reshaping the landscape and impacting customer service, risk management, and operational efficiency.

Navigating Customer Experience with AI in Financial Services

Customer service, the lifeblood of any financial institution, is undergoing a significant shift. We find ourselves in an era where customers demand seamless, 24/7 accessibility and personalized services. It is no longer a luxury; it is an expectation. Enter AI, the force that is driving this transformation.

Imagine this scenario: you need assistance with your banking queries, and you are greeted by a virtual assistant. Ever thought about how you can incorporate AI chatbots into your business? The financial industry is doing just that. AI-driven chatbots, equipped with text-to-speech technology, provide natural interactions in customer support channels. It is like having a knowledgeable friend at your service around the clock.

In times of crisis, AI steps up to the plate. AI in financial services can monitor multiple data sources, including official emergency channels and alert systems. Using a sophisticated customer engagement engine, banks connect with customers affected by disasters, offering support and assistance where it is needed the most.

Risk Management: AI’s Role in Navigating Regulatory Waters

Regulations and compliance are integral aspects of the financial sector. In the year 2020, the Global Regulatory Outlook highlighted that a staggering 33% of banks allocated or planned to allocate more than 5% of their annual budgets to compliance. This presents an excellent opportunity for AI in financial services to shine.

Consider a typical scenario where a large bank employs AI for outlier detection. The task at hand is to validate models calculating investment projections. AI performs this feat with remarkable accuracy, identifying potential areas for enhancement that traditional model validation techniques might overlook. It is a game-changer in risk management.

But, despite the vast potential, AI in legal and compliance remains largely underutilized. According to Deloitte’s State of AI in the Enterprise, 3rd edition, a mere 4% of respondents in the financial services sector reported using AI for legal and compliance purposes. This statistic reflects the untapped potential, making this area ripe for exploration and innovation.

Operational Efficiency: The AI Revolution in Streamlining Processes

Operational efficiency is the lifeblood of a successful financial institution. It is here that AI steps in, automating and standardizing processes, which ultimately leads to reduced operating costs and a streamlined workflow. The end result? Enhanced operational efficiency that unlocks a world of possibilities.

Have you ever wondered if your business efficiency is dropping due to a lack of automation? Automation in the finance industry is akin to having a team of experts tirelessly working behind the scenes. For instance, a large bank deploys speech analytics to assess calls related to loan repayment deferrals. The beauty of AI lies in its ability to detect vulnerabilities, flag interactions requiring manual review, and identify customers in need of additional support. This process not only streamlines operations but also significantly improves the overall customer experience.

Challenges of AI Implementation: Addressing Bias and Assumptions

While the potential of AI in financial services is undeniable, it comes with its fair share of challenges. AI relies on historical data to make predictions and forecasts and therein lies the challenge. It often assumes that past patterns will continue. The risk of bias creeps in when AI models are built on specific subsets of data, potentially excluding certain groups. This bias affects the accuracy of predictions and has broader implications in areas like credit scoring.

Credit scoring models, for instance, have faced issues with predictability. Inaccurate mortgage approvals and rejections are just one facet of this problem. It stems from the inherent bias within the models, coupled with the lack of sufficient data on certain socioeconomic and minority groups. These issues raise questions about fairness and ethics in AI implementation.

Selecting the Right AI Use Cases: Navigating the Path to Success

Choosing the right use cases is paramount for AI in financial services. These use cases should be small, focused, and easy to adapt, fostering a “fail-fast” culture. It is all about learning and improving as you go. Once you have identified potential use cases, the next step is assessing and prioritizing them based on their business impact and technological feasibility.

These use cases can be categorized into several tiers: the “No Brainers,” high in feasibility and business impact, driving the highest business value; the “Enhancers,” which might have lower business impact but are easy to implement and result in efficiency and cost reduction; the “Transformers,” breakthrough ideas that offer high business value but require more effort; and the “Marginals,” which have low business impact and feasibility and are best deprioritized.

Proven AI Technologies: The Power of Classification

There is a common misconception that AI use cases require bleeding-edge technology. The truth is that AI in financial services has already been in use for several years. Classification problems, for example, are pervasive in banking. Classification algorithms learn from categorized training datasets and apply that learning to classify new data into specific categories.

A Transformative Case Study: AI-Driven Call Center Compliance Automation

To understand the real-world impact of AI in financial services, consider a case study involving a leading Australian bank. The bank aimed to ensure compliance during secured lending phone calls with customers. This presented a significant challenge, given the need to validate thousands of customer interactions efficiently.

The solution came in the form of AI-driven compliance automation. By applying AI techniques to these calls, the bank achieved remarkable outcomes:

- Full review coverage of 100% of customer interactions, a feat unattainable through traditional review methods.

- Effective redirection of review teams to high-risk call segments, ensuring that human review efforts were focused where they mattered the most.

- An 85% reduction in manual review points, streamlining the compliance process.

- Valuable insights into the quality of customer interactions, enabling coaching and improvement of call centre and customer care agents.

- Enhanced customer experience, with insights benefiting multiple teams across the organization.

The responsible and ethical implementation of AI in financial services is a critical aspect of its integration. It is essential to guard against unfair bias and ensure that AI models do not perpetuate discrimination. Quantitative fairness analysis of key models and training data, particularly concerning protected features such as the gender of the call center agent, is paramount.

The initial application of AI techniques to this area of the bank was considered a Transformer use case. Yet, given the positive results achieved and the high impact on the bank’s operations, a broader roll-out of the technology to other areas became a “no brainer.”

Key Takeaway: Navigating the Future of AI in Financial Services

As we navigate the future of automation and AI in financial services, a key takeaway emerges. Prioritizing use cases based on their business value and feasibility is essential. It is a journey that requires clear communication, phased implementation, and a core focus on the customer experience. By adhering to these principles, financial institutions can stay at the forefront of innovation in this dynamic sector.

SquareOne: Shaping the Future of Automation and AI in Financial Services

The future of AI and machine learning in financial services and the role of automation in the finance industry are undeniably intertwined and poised to revolutionize the banking sector. As we delve into this digital frontier, it’s evident that SquareOne is at the forefront, offering innovative solutions that cater to the evolving needs of financial institutions.

The integration of AI in financial services is no longer a choice but a necessity. With SquareOne’s expertise, institutions can harness the power of AI to gain deep insights into customer behaviour, predict market trends, and mitigate risks effectively. The future of AI in banking is promising, and SquareOne is here to pave the way.

Automation is the cornerstone of efficiency and productivity in the finance industry. SquareOne provides tailored solutions that streamline operations, reduce manual tasks, and allow financial organizations to focus on strategic decision-making and delivering exceptional customer experiences. This is the future of automation in finance.

In conclusion, the financial services sector is on the cusp of a technological transformation. Embracing this future requires a strategic, innovative, and responsible approach to implementing AI and automation. SquareOne stands as a dedicated partner, equipped to lead financial institutions toward this promising horizon.

With SquareOne’s expertise, institutions can navigate this transformative journey with confidence, staying at the forefront of industry advancements. The financial services landscape is evolving, and SquareOne is here to shape that evolution. The future is now, and it is filled with boundless possibilities.

Embrace it with SquareOne and watch as the world of financial services transforms before your eyes, driven by the power of AI and automation.